If you are not redirected automatically, click here to download the PDF.

The Nigerian Communication Commission (“NCC”) introduced MVNO License on August 11, 2022 to be called “MVNO License” thereby creating business opportunities to entrepreneurs willing to take advantage.

Valued Added Services (VAS) license is embedded in the MVNO License therefore MVNO can carry out Value Added Services that are not currently provided by the MNOs without procuring separate VAS License. However, the MVNO licenses are forbidden from distributing VAS content created and managed by other VAS providers.

The main target of this “NCC” initiative is to direct mobile network services to unserved and underserved areas (e.g. remote rural areas) and MVNOs initiatives has been identified to play an important role in connecting and bringing access to mobile services to these regions.

Before now, MVNO is an initiative already been use in the western world including Europe and United States of America to spread telecommunications services across nooks and crannies of their countries.

The full meaning of MVNO is “Mobile Virtual Network Operators License.

MVNO is a wireless communication service provider that resells mobile network services bought at wholesale prices from Mobile Network Operators (MNOs), such as 9mobile, Airtel, MTN and Glo, for discounted amounts and resells it to consumers (End Users) at reduced retail prices under its own business brand. However, MVNO lack the network and core infrastructure to deliver network services; therefore, MVNOs depend on the host MNO to provide this. Therefore, the MNVO depends largely on the infrastructure of a fully licensed mobile telecommunication service provider.

This initiative will also help MNOs optimize use of their network resources. Rather than taking a loss, the MNO makes a small profit by offloading capacity in bulk at wholesale prices.

In furtherance of this, the “NCC” issued the License Framework for the Establishment of Mobile Virtual Network Operators in Nigeria (“the License Framework”).

Some notable provisions of the License Framework are:

(1) First, there must be a contract agreement between the MVNO and the MNO on their own terms. The agreement can either be in the form of “Revenue Sharing Agreement’ or “Wholesale Agreement”

The Agreement must be filed with NCC before applying for the MVNO License.

(2) The License is available under 5-Tier Systems

TIER MVNO TYPE LICENSE FEES

Tier 1 *SVO 35M

Tier 2 *SFVO 60M

Tier 3 *CFVO 130M

Tier 4 Aggregator/Enabler 200M

Tier 5 *UVO 500M

*SVO = Service Virtual Operator

*SFVO = Simple Facilities Virtual Operator

*CFVO = Core Facilities Virtual Operator

*UVO = Unified Virtual Operator

The best MVNO type depends on the specific market needs, the strategic goals of the MVNO, and the nature of the agreement with the MNO.

Tier 1 or 2 license are more of a plug-and-play, but inherently more dependent on the MNOs and will need a solid voice to ensure good service from the MNOs network team. The lower-tiered MVNOs are more closely dependent on the MNO’s efficiencies than the higher-tiered MVNOs.

Aside from the licensing requirements, applicants are required to have one (1) unique technical partner and observe its Local Content Policy.

License tenure and payment plan

The MVNO License is valid for a period of ten (10) years with an option to renew the license for another 10 years.

Applicants for tier 1 – 4 licenses are required to pay 5% of the applicable license fee as non-refundable administrative charges, while tier 5 applicants are expected to pay Fifty Million Naira (N50,000,000.00).

Detailed Services under the Tiered System

The details level of services provided per each Tier are enumerated below:

TIER 1 SERVICES VIRTUAL OPERATOR (SVO)

▪ SVOs can offer services to customers without owning intelligent or switching network infrastructure.

▪ Host operators have the responsibility of providing wholesale capacity to the SVOs to provide their products and services. Thus, the host operator has a strong effect on the pricing of the SVO’s services.

▪ The VAS license is included in the SVO license; therefore, where an SVO provides VAS services, the conditions within the VAS license must also be complied with.

▪ The SVO can run its Short Message Service Centre (SMSC), which is a mobile phone network that handles text messages operations.

▪ The SVO licensee is in control of its brand, sales, distribution channels, device and phone sales and management, and customer relation platform.

▪ The tariff control here is very limited.

TIER 2 SIMPLE FACILITIES VIRTUAL OPERATOR (SFVO)

▪ The SFVO has more control over its value chain than the Tier 1 licensees and can distinguish itself from the host.

▪ The SFVO can set up its intelligent network but does not have core switching and interconnect abilities.

▪ In addition to the features from Tier 1, SFVO has the ability to own its Home Location Register (HLR), Equipment Identity Register (EIR), Authentication Centre (AUC), Home Subscriber Server (HSS), own more customers and own and issue its own SIM.

▪ SFVOs can have their own short codes for customer care services.

▪ In relation to inbound calls, SFVOs share revenue structure with their host operators.

▪ The SFVO can generate its revenue because of its ability to control its pricing and tariff structure.

TIER 3 CORE FACILITIES VIRTUAL OPERATOR (CFVO)

▪ In addition to the features from Tier 2, CFVOs can launch and operate a full core network with interconnect and switching capabilities, such as Mobile Switching Center (MSC), Gateway Mobile Switching Center (GMSC), Packet Data Network Gateway (PGW), Serving Gateway (SGW) and Mobility Management Entity (MME). However, for radio access, they rely on their host operators.

▪ Unlike SFVOs, CFVOs have full control over their tariff structure as they do not share revenue structure for inbound and outbound calls.

▪ The Commission urges CFVOs to target unserved and underserved areas and offers subsidised requirements for CFVOs who operate in these areas.

TIER 4 VIRTUAL AGGREGATOR /ENABLER

▪ The Virtual Aggregator/Enabler is a middleman between the Mobile Network Operators (MNOs) and the other Virtual Operators. The Virtual Aggregator/Enabler buys network services from MNOs in bulk and then resells to other Virtual Operators.

▪ The Virtual Aggregator generally known as Mobile Virtual Network Aggregator (MVNA) has the liberty to choose the value chain it wants to aggregate. Thus, it can aggregate Virtual Operators from Tier 2 if it controls its intelligent network and content delivery platforms but relies on the host operator to provide switching and interconnect purposes.

▪ The Enablers generally known as Mobile Virtual Network Enablers (MVNEs) provide the platform other Virtual Operators need for business and operations support systems processes which in turn gives the Virtual Operators the opportunity to center their attention on marketing, sales and distribution aspect of their business.

▪ In unserved and underserved areas, the Virtual Aggregators/ Enablers can perform the role of CFVOs.

TIER 5 UNIFIED VIRTUAL OPERATOR

▪ The Unified Virtual Operators (UVOs) can choose to operate at whichever tier and offer services at such level.

▪ UVOs can enter into a Shared Rural Coverage Agreement with a licensed spectrum owner to directly provide services for customers in unserved and underserved areas.

▪ They can offer all the services in Tiers 1 – 4

Becoming an MVNO

Becoming an MVNO is challenging, but with the right approach, it can be a profitable venture. To better your chances of launching a successful MVNO business, you should start with the following:

At present the applications for MVNO license has been suspended after initial deadline of 11 of October 2022. Futures lifting of the suspension is inevitable

We present AP Professional Services perspective to ESG Audit and Sustainability Assurance practices.

In a constantly changing audit landscape, achieving efficiency, accuracy and consistency is necessary. One of the new and latest reporting needed to be integrated in an Audit Engagement is ESG Audit and Sustainability Assurance. ESG addresses organization’s responsibilities beyond taking care of their bottom line (Profits) and financial performance.

In the past, we have integrated Tax and Company Secretarial Audit into our audit process. Now it’s the time to integrate a fully ASSURANCE PROCESS into our Annual Audit plan.

ESG stands for Environmental, Social, and Governance. Another name for ESG is Corporate Social Responsibility (CSR). For illustration purposes, CSR is like what Management Accounts (Unaudited Financial Statements) or better still Trial Balance is to organizations while ESG is the AFS and Sustainability reporting is like the Audit Opinion.

Sustainability assurance refers to providing independent assurance or verification of an organization’s sustainability-related information, performance, or reporting. Sustainability Assurance is what Audit Opinion is in traditional audit.

Business leaders increasingly see sustainability as pivotal to risk management and value creation. In line with this trend, more and more companies are investing in third-party assurance for ESG and sustainability reporting to mitigate risk and bring valuable benefits.

It’s about assessing how your company’s operations impact the world and ensuring these actions are aligned with your values and the values of society at large.

There are some countries that are charged with Mandatory ESG Reporting. However, it can be adopted as voluntary obligations in countries where it is not mandatory. In those countries where ESG Reporting is mandatory, regulations are in place demanding certain companies to provide specific financial or non-financial data disclosures in their strategic report.

Some of Mandatory ESG Reporting areas are:

(1) Climate-related disclosures in financial reporting.

(2) SEC demands from publicly traded companies to submit annual reports on human capital resources (HCR)

RELATED SERVICE PROVIDERS

ESG Assurance Providers

Sustainability Assurance Providers

NOTE: Experienced Chartered Accountants and Auditors are the best fit to perform ESG audit services as they have vast experience in determining whether a client is in compliance with multiple standards and frameworks.

What is ESG reporting?

ESG reporting is an organization’s public disclosure of its environmental, social, and corporate governance data in order to ensure transparency into the organization’s ESG activities and measure its sustainability performance so stakeholders, such as investors, consumers, and NGOs, can make better-informed decisions.

A comprehensive and continuous ESG auditing helps protect organizations from ESG-related risks. ESG audits is part of a Risk Management tools that helps organizations identify and assess their impact on the environment and society, and develop strategies for mitigating or otherwise addressing ESG risks. Also, ESG Audit is an essential source of information for investors, employees, and customers, who demand accurate information and transparency around how organizations approach ESG issues. ESG Audit allows companies and organizations to benefit from stakeholder confidence, regulatory compliance, and an enhanced reputation.

ESG Audit is needed where pressure on any of these ESG elements (Environmental, Societal and Governance) are identified:

(a) An organization is exposed to Environmental pressures. Example is the Climate Change impact, waste management challenges, hazardous materials handling, pollution impact and supply chain depletion (depletion in source of material supply).

(b) An organization is exposed to societal pressures as a result of relationships with Employees, Customers, Communities. Examples are procedures to adhere to Labor laws, procedures not to violate human rights, policies on child labor and work conditions, Data Protection and privacy risk and policy framework on DEI Issues (Diversity, equity, and inclusion)

(c) An organization is expected to abide and make disclosure regarding laid down code of conducts and sets of Corporate Governance rules and regulations

ESG REPORTING FORMAT (ESG FRAMEWORK) Four well-known ESG frameworks are:

(1) Sustainability Accounting Standards Board (SASB)✅

Presently, ISAE-3000 (revised) is an assurance standard by the International Auditing and Assurance Standards Board (IAASB) that deals with assurance engagements other than audits or reviews of historical financial information. ISAE3000 on provide guidance for ESG Audits.

ISAE stands for International Standards of Assurance Engagements. ISAE are issued by issued by the International Auditing and Assurance Standards Board (IAASB)

Newly, we are having ISSA5000 to replace ISAE3000 as one unified guidance for a standard Sustainability reporting and combined guidance for both ESG Audit and Sustainability Assurance.

ISSA stands for International Standards Sustainability Assurance. ISSA issued by the International Auditing and Assurance Standards Board (IAASB)

(2) Task Force on Climate-Related Financial Disclosures (TCFD)

(3) ISO Standards. International Organization for Standardization.

Some useful ISO standards that provide ESG audit frameworks include ISO 26000 (Social Responsibility), ISO 14001 (Environmental Management Systems), and ISO 45001 (Occupational Health and Safety)

(4) GRI: The most popular or well-known of these frameworks comes from the Global Reporting Initiative (GRI). This framework is focused on sustainability and impact reporting.

NOTE: SASB offers sector-specific guidance while TCFD is more specifically geared towards climate issues. As some frameworks address a specific aspect of ESG, you may want to consider whether using or combining parts of multiple frameworks makes sense.

Any ESG reporting frameworks adopted will provide guidance to:

(a) Identify ESG topics or better still risk areas

(b) Provide criteria on how to structure and prepare information to disclose for each topic.

STEPS ON HOW TO CARRY OUT ESG AUDIT (HOW TO PERFORM ESG AUDIT)

(a) Data collection (Data Mining) from stakeholders in order to understand and identify specific ESG Risk Exposure. Automate this process for continuous auditing and evidence collection

ESG data refers to information related to a company’s environmental impact, social responsibility, and governance practices.

Types of ESG Data

The different types of ESG data can be broadly categorized into the following areas:

(b) Select an ESG framework that aligns with your organization’s goals.

(c) Set up ESG Goals and KPI per each ESG potential risk identified. This will be used to determine if Risk is POTENTIAL or not.

(d) Map out strategy to manage and mitigate against potential risks identified under c above

ESG AUDIT RISK

Companies that fail to manage or mitigate ESG risks face financial, reputational, and legal cos

1. Bureaux de Change (BDCs) now have tiers: Tier 1 requires a minimum capital of N2bn (this is for a national license), while Tier 2 has a minimum capital requirement of N500m (these can only operate within one state and are allowed a maximum of 3 branches).

2. A shareholder cannot own more than one BDC, thus preventing people from holding more than one license.

3. BDCs can now serve as agents to disburse funds on behalf of International Money Transfer Operators (IMTOs). Only amounts less than $500 can be received in cash, while larger amounts should be deposited in bank accounts. For foreigners, a card will be issued. Essentially, BDCs will now be able to issue Naira cards.

4. BDCs can now issue PTAs and BTAs.

5. BDCs are going digital and will need to integrate the Central Bank of Nigeria (CBN) reporting platform for transaction and Anti-Money Laundering (AML) purposes. They will also integrate Federal Inland Revenue Service (FIRS) and Nigeria Inter-Bank Settlement System (NIBSS) for Bank Verification Number (BVN) verification, among other things.

6. As a Tier 1 BDC, you must have a minimum of 5 board members and a maximum of 9. Tier 2 should have 7 members. The draft guideline provides for gender equality, so a board cannot be constituted with only one gender. The CBN must now approve of directors serving on the board of a BDC and another regulated financial institution. New qualifications now require board members to have experience working in financial institutions. In particular, independent directors must have worked on the management team of a BDC.

7. Banks and Other Financial Institutions (OFIs) cannot hold Bureau De Change (BDC) licenses. It remains to be decided whether some of the permissible activities of BDCs under the draft regulation, such as the issuance of Business Travel Allowance (BTA) and Personal Travel Allowance (PTA), will be exclusively reserved for the BDC.

8. There is now a very extensive requirement for licensing. It’s a whole lot. It is very similar to what the CBN would demand from a finance company or bank, with increased scrutiny.

9. Unlike banks- BTA/PTA threshold they can sell is biannual – sell 4k to individuals and 5k to businesses cumulatively in a 6-month period

10. No more street trading.

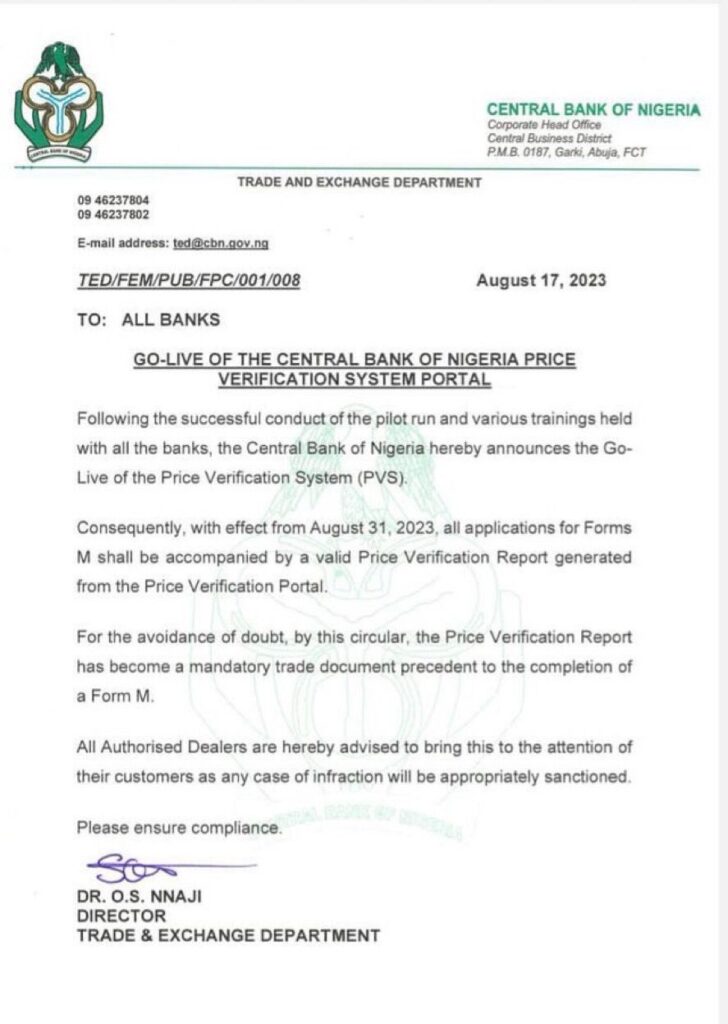

The pilot project was launched on 1st February.2022 following an awareness notice in a circular in the August 2020.

REGISTRATION

Suppliers and buyers of goods and services for Import/Export operations into or out of Nigeria are required to register on a dedicated electronic portal provided by the CBN and operated by its agent service providers as in the operational manual for Form M & Form NXP;

An annual subscription fee of $350.00 is charged for the authentication of suppliers on the TRMS system.

E- INVOICE AND E-EVALUATOR

The PVS is also referred to as E-invoice and E-evaluator initiatives because it requires submission of an electronic invoice (E-Invoice) authenticated by Authorized Dealer Banks (ADB) on the Nigerian Single Window Portal – Trade Monitoring System (TRMS). The e-Valuator and e-Invoice would replace the hard copy invoice and become a necessary supporting document for all import and export transactions.

HOW IT WORKS

The price verification report from the portal is now mandatory for all Form M requests, effective from August 31, 2023. The PVS will be a process to be completed before the Form M submission stage on the single window platform and on the Trade Monitoring System (TRMS)

The PVS mechanism will be guided by a benchmark price of goods and services in the market where the goods are traded, to ensure that the invoiced prices are based on spot market prices at the time of invoicing. It is hopeful that the PVS will help in safeguarding the scarce foreign exchange (forex) by ensuring that forex is allocated for eligible transactions.

Imports and exports with prices more than 2.5% of the verified prices will be queried and will not be approved for either Form M or Form NXP. The aim of this system is to achieve accurate value of import and export items in and out of Nigeria.

EXEMPTIONS

The following transactions are exempt from submitting PVS:

CBN will regularly update prices on the portal while the prices of every item will be reviewed at least quarterly and more frequently for goods with higher price fluctuations.

President Tinubu’s Palliative measures centers around

(1) Financial assistance to businesses

(2) Food Security agenda

(3) Transportation

(4) Minimum wages

Going by the president’s speech, it suggest that the idea to give ₦8,000 per month for a period of six months to low-income earning household has been jettisoned. Probably replaced with FOOD SECURITY AGENDA. This was assumed since it was not mentioned in the nationwide address.

Find details of ALL the Palliatives proposed measures below:

FINANCIAL ASSISTANCE

MANUFACTURING BUSINESSES

Between Jul 2023 and Mar 2024 to 75 manufacturing enterprises will have access to N1Billion Loan at 9% per annum with a maximum of 60 months repayment for long term loan and 12 months for working capital in order to enhance their production capacity and in turn create good-paying jobs.

NON-MANUFACTURING BUSINESSES

Micro, Small, and Medium-sized Enterprises (MSME) will have ₦125bn funds to access.

FOOD SECURITY AGENDA

Multi-stakeholder engagement with various farmers’ associations and operators within the agricultural value chain that will ensure staple foods are available and affordable by embarking on the following plans:

(1) to support cultivation of 500,000 hectares of farmland and all-year-round farming practice remains on course.

(2) ₦200bn of the ₦500bn approved by the National Assembly will be disbursed as follows:

(3) to release 200,000 MT of grains from to households across 36 States and FCT free of charge.

(4) to provide 225,000 MT of fertilizer, seedlings and other inputs to farmers who are committed to the food security agenda above

TRANSPORTATION

Provision to invest ₦100bn between now and Mar 2024 by acquiring 3,000 units of 20-seater buses in order to roll out buses across the states and local governments for mass transit at a much more affordable rate

These buses will be shared to major transportation companies in the states and the companies will be able to access loan under this facility at 9% per annum with 60 months repayment period in order to fund its repayment of the buses.

MINIMUM WAGE

“I want to tell our workers this: your salary review is coming.”

Already working in collaboration with the Labour unions to introduce a new national minimum wage for workers.

Budget provision will be made for the immediate implementation of the new minimum wage once it is agree and determine.

OTHER COMMITMENTS

(1) To fulfill the promise to make education more affordable to all and provide loans to higher education students who may need them.

(2) Currently monitoring the effects of the exchange rate and inflation on gasoline prices. To intervene If and when necessary.

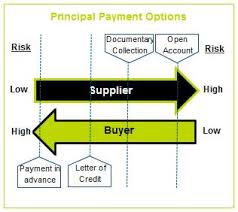

The best way to protect yourself as service providers, contractors or vendors against the risk of failure to receive payment upon delivery is to demand for some “Typical” Guarantee or Bond from BUYER. These guarantees and bonds are to be procured before delivery is made to the BUYER.

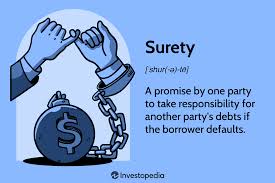

The execution of GUARANTEES or BONDS creates three parties as follows:

Buyer = Project owners (Primary Obligor)

Seller = Contractors, Vendors, Suppliers, exporter (Beneficiary)

Surety/Guarantor = Bank or Insurance Companies

These ”typical” Guarantees or Bonds are issued by the Surety/Guarantor at the request of the BUYER upon payment of Premium (%) of Contract Value.

The SELLER can demand for any of the financial guarantee and bonds listed below for protection the protection of their payment

(1) Deferred Payment Guarantee

(2) Letter of Credit (Inland or Foreign)

(3) Post Dated Cheques

(1) DEFEERED PAYMENT GUARANTEE

This is an assurance to the SELLER that BUYER will pay for goods supplied on a specific date. That is, BUYER will commit to a specific period in which all outstanding payment will be paid to beneficiary.

The maximum credit days (the specific date to pay) in DPG should be maintained at 90days

The seller offers credit to the buyer and buyer’s bank guarantees the due payments to the seller.

Perform = Payment

The Guarantee is issued by the Bank or Insurance company at request of BUYER in favour of SELLER

(2) LETTER OF CREDIT (LC)

Letter of Credit is a promise or commitment in writing made by a bank to a particular seller that payment will be made to the seller if the seller completes performing whatever is mentioned in the letter of credit. Payment here is not trigger by SPECIFIC DATE, payment is trigger once DELIVERY is made to BUYER. Letter of Credit is only used in foreign transactions. The type of Letter of Credit used for domestic transaction is called INLAND LC

LC is a form of Guarantee and is issued by the Bank or Insurance company at request of BUYER (local or foreign) in favour of SELLER

(3) POST DATED CHEQUES

Postdated cheque is one that is written with a future date indicated on it. This is usually done to account for an anticipated delay in deposit.

In Nigeria, like any ordinary cheques, post-dated cheques have a validity of 3 months from the date of issuance.

Post Dated Cheque is not a Guarantee issued by the Bank or Insurance company but rather an understanding between BUYER and SELLER to take advantage of illegal issuance of Post-Dated cheque without sufficient funds as a form of Guarantee for payment

*Knowledge shared here are for Sales and Marketing team of an organization or any individual assuming such a roles.

The best way to protect yourself as “project owners” is to demand for some “typical” Guarantee or Bond from potential service providers, contractors or vendors against the risk of non-performance or undue delay in project completion. These guarantees and bonds are purchased before contract is given to the SELLER.

The execution of GUARANTEES or BONDS creates three parties as follows:

Buyer = Project owners (Beneficiary)

Seller = Contractors, Vendors, Suppliers, exporter (Primary Obligor)

Surety/Guarantor = Bank or Insurance Companies

These “typical” Guarantees or Bonds are issued by the Surety/Guarantor at the request of the SELLER upon payment of Premium (%) of Contract Value.

The Project owners can demand for any of the financial guarantee and bonds listed below for their protection in case of delay or non-performance from service providers, contractors or vendors

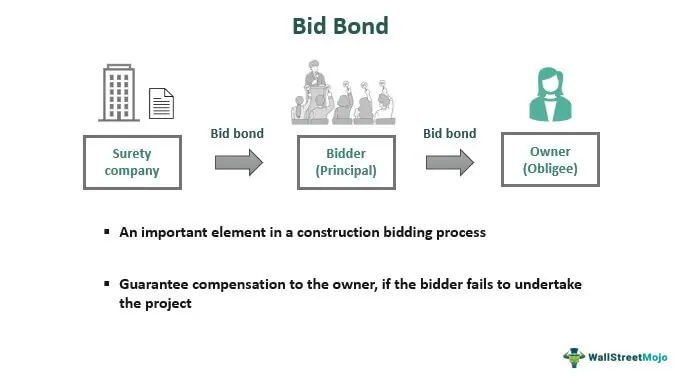

(1) Bid or Tender Bond

(2) Performance Bond or Guarantee

(3) Advance Payment Bond or Guarantee

(4) Warrantee or Maintenance Bond

(5) Counter Guarantee

(1) BID OR TENDER BOND

This is an assurance to the BUYER that SELLER will not withdraw its bid before conclusion of the bidding process and that SELLER is financially Capable to undertake the project should it be awarded to them and that SELLER will be able to get a performance bond if chosen to do the job. These bonds are usually between a Premium of 2% and 5% of the total contract value. The Premiums may be lower for projects with higher values or SELLERS who have good credit scores.

If a bid or tender bond is in place however, in the event of the contractor falling through, the supplier would be awarded the value of the bond as a penalty against the contractor.

(2) PERFORMANCE BOND OR GUARANTEE

Issued to a Project owners as a condition precedent for execution of a Contract needed after successful acceptance of bid and may raise the need for Advance Payment Guarantee (APG)

This is an assurance to the BUYER should there be delay of failure to PERFORM, the SELLER will take over the responsibility to PERFORM by engaging another SELLER

Performance Bond value is usually a Premium of 10% of the Contract Sum (this is not sacrosanct and may vary in accordance with the Contract Particulars). The Premiums may be lower for projects with higher values or SELLERS who have good credit scores.

If it’s a Bond, the BUYER will demand for Financial Compensation from the Bank that issued the BOND irrespective of whether there is performance or not. If it’s a Guarantee, the BUYER will have to present a case of NON-PERFORMANCE before the Bank can pay,

In a standard BID Process where emphasis on Performance is made, Performance Bond will take-over from a Tender Bond where such exist. The Two cannot be in existent at same time.

A performance bond are introduced as security for job completion and is usually issued by thee bank or insurance company of the SELLER.

Perform = Satisfactory completion of a project

(3) ADVANCE PAYMENT BONDS OR GUARANTEE

Issued to a Project owners as a condition precedent to payment.

An assurance that the SELLER will refund any advance payments that have been made to the BUYER in the event that the product/project is unsatisfactory. APG enables the SELLER to recover Advance Payment already paid to BUYER in the event the SELLER is unable to perform or fulfill obligations under Contract

This will provide protection to the Buyer when an advance or progress payment is made to the Seller prior to completion of the contract

(4) WARRANTY OR MAINTENANCE BONDS

An assurance that SELLER will pay to the BUYER an amount of money in case the warranty obligations for products that are provided are not met. This means, the such payment received by BUYER will serve as a substitute for a filed warranty.

The bond is returned by the buyer at the end of the warranty period if the product that is provided has met the specifications.

(5) COUNTER GUARANTEE

This is similar to Performance Guarantee except that it is only needed when bidding for project in foreign countries In involve two banks: The local and foreign banks.

A cross country guarantee in the form of guarantee for guarantee given by another Bank

NOTE. A Bond can either be On-Demand or Conditioner

On-demand bonds :

Value set out in the bond is immediately paid on a demand

Conditional bond :

There is only liability if there is a breach of contract (or certain event has occurred as set out in the bond)

*Knowledge presented here are useful to The Procurement Unit of an organization or any individual assuming such role

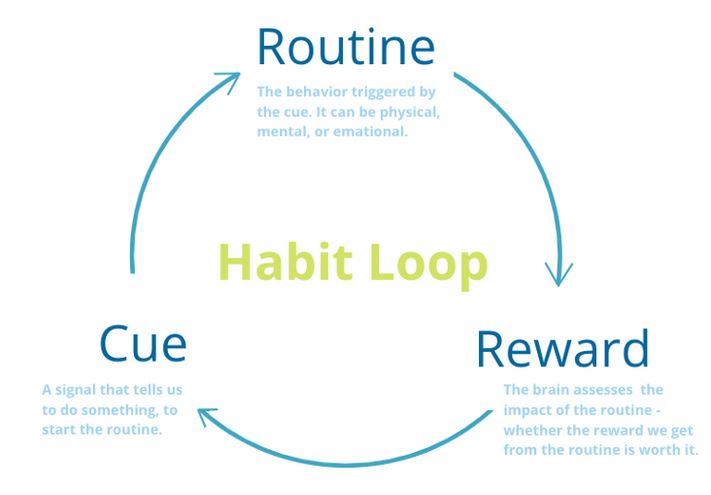

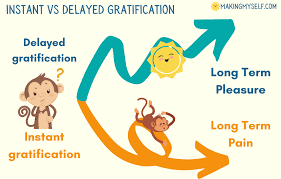

The most successful people in any society are those who take the longest time period into consideration when making their day-to-day decisions. TAKE LONG TIME BEFORE A MAJOR DECISION

We can look at Time Perspective from Plant Trees and Doctors Training perspective to get a quick clue.

Plant Trees

What Banfield found was that the higher a person rises in any society, the longer the time perspective or time horizon of that person. People at the highest social and economic levels make decisions and sacrifices that may not pay off for many years, sometimes not even in their own lifetimes. They “plant trees under which they will never sit.”

Doctors

An obvious example of someone with a long time perspective is the man or women who spends ten or twelve years studying and interning to become a doctor. This person takes extraordinarily long time to lay down the foundation for a lifetime career. And partially because we know how long it takes to become a doctor, we hold doctors in the highest esteem of any professional group. We appreciate and admire the sacrifices that they have made in order to be able to practice a profession that is so important to so many of us. We recognize their long time perspectives.

Long Time Perspectives

People with long term perspectives are willing to pay the price of success for a long, long time before they achieve it. They think about the consequences of their choices and decisions in terms of what they might mean in five, ten, fifteen, and even twenty years from now.

Short Time Perspectives

People at the lowest levels of society have the shortest time perspectives. They focus primarily on immediate gratification and often engage in behaviors that are virtually guaranteed to lead to negative consequences in the long term. At the very bottom of the social ladder, you find hopeless alcoholics and drug addicts. These people think in terms of the next drink or the next fix. Their time perspective is often less than one hour.

Delayed Gratification is the Key to Financial Success

Your ability to practice self-mastery, self-control, and self-denial, to sacrifice in the short term so you can enjoy greater rewards in the long term, is the starting point of developing a long time perspective. This attitude is essential to financial achievement of any kind.

Action Exercise

Practice a long term perspective in every area of your life, especially in your financial life but also with your family and your health. Think of where you would ideally like to be in five years and begin today to take steps in that direction.

It’s no longer news that Lagos State Government has introduced two technology driven cameras till date. Vehicle owners are advised to regularly visit the two platforms to check for any possible Traffic Offense Billing for onward PAYMENT or CONTEST.

The two technology driven platforms are:

(1) Mobile Body Cameras (Traffic Management System TMS) – Operated by LASTMA

You can either use your Vehicle plate number, Violation number or Ticket number to search for any pending traffic offense bill

https://tms.lagosstate.gov.ng/Mobile/mClientHome.aspx

(2) Fixed Traffic Camera (PayVis ) – Operated by VIO

You can either use your Vehicle plate number or Bill number to search for any pending traffic offense bill

(1) Traffic Management Solutions (TMS)

Traffic Management Solutions Devices was deployed in May 2023 to enable evidence-based prosecution of traffic violators.

Previously (July 2021) body cameras was employed, but the latest deployment will ensure that traffic offenders are captured from a distance.

The technology is a solution to LASTMA officials having altercations or struggling or trying to make arrests of motorists causing infractions on the road. Now, this camera captures traffic infractions from a distance. That means the LASTMA official will not be closer to you this time around before capturing you if you commit any traffic infractions.”

Notice in the form of video evidence will be sent to the traffic offender to justify infraction committed.

Traffic offenders can contest the video evidence. Under the video, you have three buttons there. One is to challenge it if you want to challenge it, probably you have the feelings that you have not committed such offense, you will be charged to a mobile court.

TMS has a learning modules with easy to assimilate animated representations of traffic laws and the effects their violations

TMS also has the Eyewitness function which allows road users the opportunity to also play a role in reducing traffic gridlocks by reporting observed traffic offenses, vehicle breakdowns, dysfunctional traffic lights, faded road markings etc, positioning everyone as a potential change maker in the traffic situation.

TMS also has a beautiful Mobile App, available for download from the Google Play Store and the App Store, which makes all these functions very easily available on mobile devices.

(2) PAYVIS (Plate Detection Platform)

PayVIS is a technology- driven plate detection platform that will capture plate number of traffic offenders and bill them. It was introduced in the January 2021.

VIO is in charge of its management

The cameras are located besides traffic lights to capture traffic offenders without the presence of traffic officials. The Camera will take photo shot of offenders plate number and run a scan on Lagos State Database to detect prior traffic offenses or expired vehicle papers so as to add it up to offenses committed.

NOTE, you can contest the bill

How to contest your bill under PayVIS Platform