SARAKI AUDIO (Sorry for non Yoruba speaking, I will run the interpretations here below) ☝️

When I told you in my previous campaign that this rouges treat Nigeria as a a PLC, some of us think it’s an understatement.

BUHARI HAS CHARACTER AND INTEGRITY AND CANNOT REWARD EVIL DOERS, ENEMIES OF GOOD GOVERNANCE, TREASURY LOOTERS AND VIOLENCE ENGINEERS WHO USE PROPAGANDA AND BLACKMAIL TO BLACKLIST OUR FATHERLAND AND CUT-OFF INVESTMENTS AND INVITE FOREIGNERS TO KILL OUR PEACE.

ENGLISH INTERPRETATION OF SARAKI AUDIO?

“All that you have complained about tonight is on point, I can not find anything you have said that is not on point, you complained about empowerment”

“Let us agree that the last 3 and a half years, things have not been easy at all, I agree and accept things have not been easy at all, particularly in the area of empowerment”

“Before 2015 I have always tried to empower the youth and get you involved in appointments, but this time around as a result of what I call human factor, things have not been the same, I believe it is the will of God”

“When you all are complaining and you give example of Gegele and co and you compare it to what is happening now, I am sure you are asking yourself, what is happening? how come all of you struggling with me are not rewarded, it is unacceptable”

“What is the point of putting everything into the emergence of a government and we could not benefit anything from the government, you are asking yourself, what have you benefited”

“If you have not benefited personally in the last 3 and a half years, how do you go to market us, wont people ask you what you have benefited for yourself?

“It got to a stage that people will be making fund of you and asking you what you have benefited, but what is happening from Abuja, use me as an example, in 2015 I carried APC on my head around Nigeria”

“Hardly any state in Nigeria that I did not campaign for Buhari, up to the time of the election in 2015, out of 36 states I paid for the election of 30 states”

“Out of 36 states in Nigeria I funded Buhari campaign in 30 States, some states I paid 200 Million Naira, some 300 Million, some 400 Million, the only states I did not fund are South West States”

“Many times I will be calling my Banks to send money to fund elections across Nigeria for Buhari my thinking was that when we get elected, the next thing is that we will get majority of our people appointments”

“In fact I had already promised some of you here that you will either be MD of Federal agencies, either road maintenance, NIPDA (inaudible) even Nigerian Ports Authority, SUBEB and so on and so forth”

“I know if I put someone amongst you from Kwara even in the smallest Federal agencies, the contract you will sign out, 1Million, 2 Million, but for the first time that I have been in politics even speaker cant appoint a cleaner”

“I as President of the Senate I could not even appoint a cleaner not to talk of Board appointment, if you look at Executive positions I have nothing even after spending Billions for 3 and a half years, I am as angry as you are ”

“I am fighting Buhari because of you, if it because of me I wont fight, it is not easy to fight the federal government, the sufferings you are all going trough is because they did not fulfil our agenda”

“In 2018 I told you all I wont be going with APC but in the last one or 2 months that I left I have been doing a lot for you people, my politics is for all of you, I am just here to empower you all, dont mind the one who just bought form for 33M ”

“It was not my plan not to appoint you, when David Mark was Senate President, every confirmation he made for the President came with something, if they really love us now you will be empowered”

“In the past we they have a cut for Senate President and Speaker but not anymore, so we are no longer going with APC as soon as we joined PDP they called me National Leader when I lost election Atiku came to me immediately”

“Now we have seen the sign that if Atiku becomes President things will come to us, he told me I am the only one that can run his campaign, I know it is not easy for you all, but let me assure you things will be better”

“God see my “aniyan” (Arabic word) now in PDP they have brought us closer, how many people in Kwara did APC bring together in Kwara, now we will soon have power, today in APC they want us to go to Asiwaju Tinubu in Lagos”

“If I am the only one in PDP I will fight alone, my Father made Kwara and took Kwara to the top 10 in Nigeria and I also took Kwara to between number 1 to 3 in Nigerian politics and they now want us to bow to Lagos”

“In the coming election we will put Youth into power in Kwara, let us take Atunwa as he his, he will take care of you all, all those who contested against him are loyal but Atunwa will….. inaudible” (applause)

“When I was Governor I gave a lot of young people contract, they buy land etc and then empower others, I want to return you to the days of when I was Governor when you were all enjoying, Atiku will open things when we win election”

“You know as a leader I see things that followers dont see, when we followed Buhari we felt after spending money, we saw that he failed to reward us, so we said this Baba is not coming back, no money, no patronage all over Nigeria”

“Even with all the problem we have with Buhari the little cut I get I always send to Kwara but I can tell you that we had to design a method to make the little we have, they did not involve us in sharing”

“The only agenda APC have for Kwara is to fight Bukola Saraki , they favour Osun State with empowerment, for the remaining time of Buhari we will still get some things, we gave them list for FIIRS for 3 years they did not employ our list”

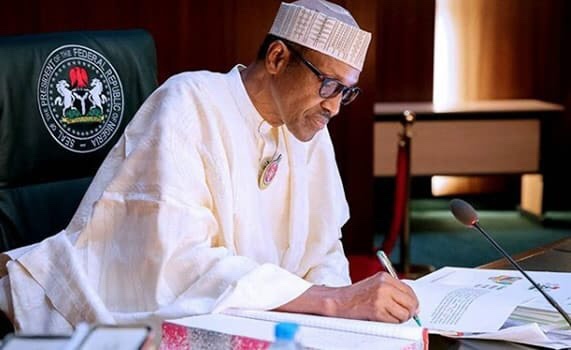

The signing of this order on Friday (January 25, 2019) is another milestone recorded by Buhari led Federal Government to rapidly close the infrastructure gap left by previous administrations. Participating investors will use their funds to build infrastructure and return get incentives in the form of tax credits to reduce their corporate taxes payable to government until they recoup the value of their investments in roads and bridges.

The signing of this order on Friday (January 25, 2019) is another milestone recorded by Buhari led Federal Government to rapidly close the infrastructure gap left by previous administrations. Participating investors will use their funds to build infrastructure and return get incentives in the form of tax credits to reduce their corporate taxes payable to government until they recoup the value of their investments in roads and bridges.